Venture Philanthropy Meets Venture Capital - Innovate SOMO Funds Blaze a Trail

April 18, 2024

The dream of becoming a tech entrepreneur is often just that—a dream—for founders outside of major metro hubs like Silicon Valley, Boston, and New York. While capital seems to be flowing again for late-stage startups, the long-standing pre-seed and seed funding drought continues in smaller cities and rural areas across America's heartland.

The reality is, more than 80% of venture capital in the U.S. goes to companies in just a handful of counties,1 leaving huge swaths of the country underserved. This stifling of potential hits at a pivotal time when cultivating homegrown job-creating tech startups is crucial for economic vitality and quality of life in our communities.

Today there is a new beacon of opportunity with the launch of the Innovate SOMO Funds, a pioneering venture fund that blends philanthropic giving with traditional venture capital. By deploying charitable capital alongside institutional investment, Innovate SOMO Funds aims to close startup funding gaps, especially for promising pre-seed and seed-stage tech founders.

Innovate SOMO Funds are owned and managed by the Codefi Foundation on Rural Innovation, and are the latest in a series of developments led by Codefi2 and efactory3 at Missouri State University, co-creators in the Southern Missouri Innovation Network4 (Innovate SOMO). Innovate SOMO is a regional collaborative working to unlock the full potential of entrepreneurship and innovation to transform entire communities in the southernmost 47 counties in Missouri.

The Importance of Job-Creating Startups

Startups are well known as economic engines, creating the vast majority of new job opportunities in recent decades. In an analysis of business dynamics in the U.S. since 1980,5 researchers found that existing firms that were five years or older, destroyed more jobs than they created nearly every year. The net job creation rate for young firms, or startups, five years or younger, average nearly 20% during that same period.

Startups are leading net job creation across Missouri as well. In the 2023 Show-Me-Jobs6 report, first-time employers created 81% of all new jobs produced during 2018-2022. Tech-enabled startups, in particular, offer an upwardly mobile path by generating high-paying roles like software engineering, data science, cybersecurity, and more. In Missouri, average wages paid from tech startups were nearly 91% higher than all establishments. Moreover, tech wages increased 15.8% from 2018 to 2022, while the average wage for all establishments increased only 11%. Not only are tech wages substantially higher but also they grow faster.

The Importance of Early-Stage Capital

Tech startups have the unique potential to create high-quality jobs, boost local economies, and improve the quality of life for communities. By catalyzing innovation, these companies can transform industries and drive economic growth. However, this potential can only be realized if these startups receive the necessary funding and support in their early stages.

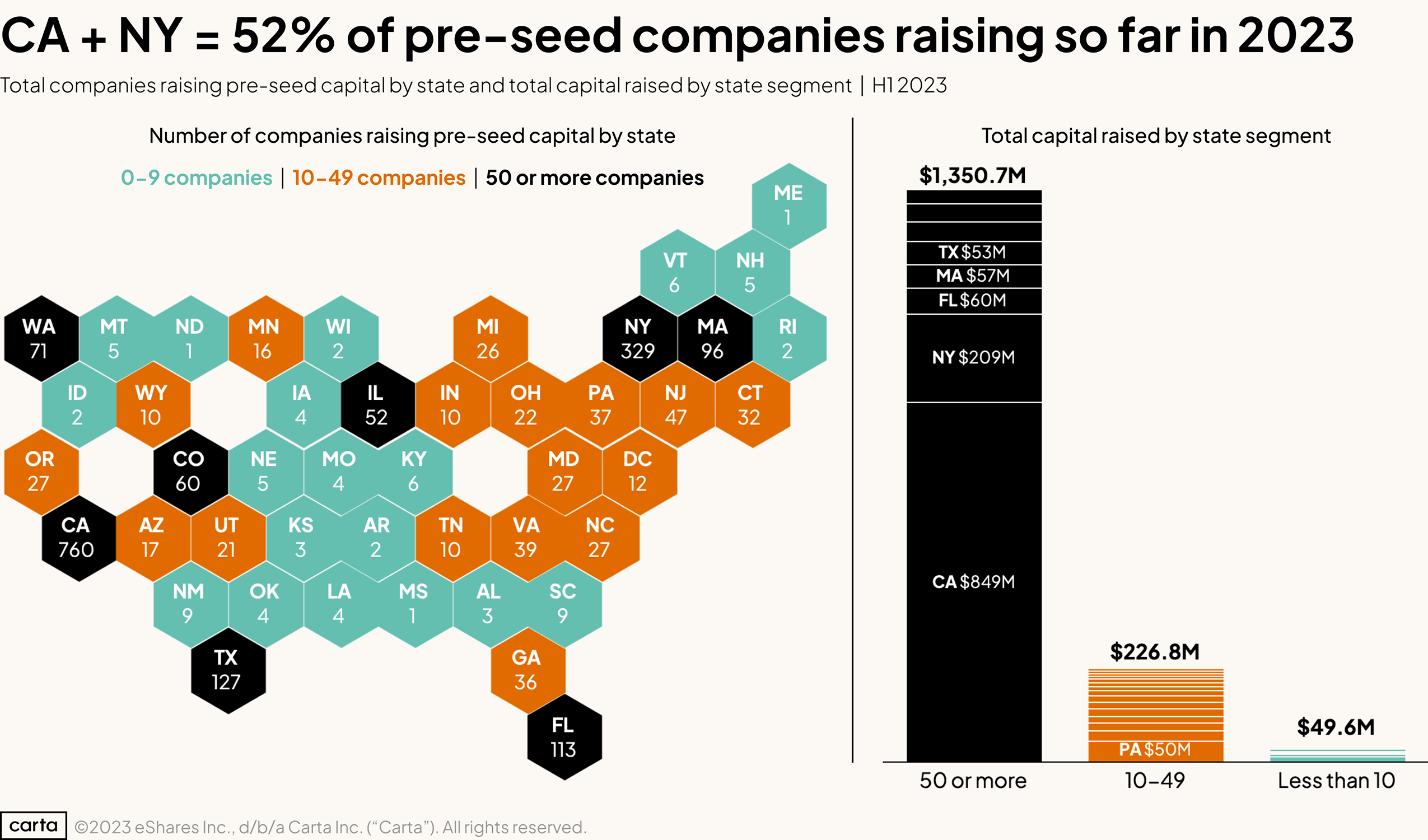

According to a study published by Carta on the state of pre-seed fundraising,7 pre-seed deals slowed substantially the first half of 2023 after a big uptick in 2021 and 2022, following the pandemic. Of the 2,103 pre-seed investments captured on Carta, 52% of them were closed in California and New York. Only four (4) of those pre-seed investments were captured in Missouri. If this is representative of current investment dynamics, it indicates how the lack of early-stage capital disproportionately impacts underrepresented founders and ecosystems beyond major coastal hubs. This concerning trend risks stifling innovation and preventing transformative ideas from ever reaching escape velocity.

Catalyzing Innovation: Strategies for Missouri to Drive Innovation and Entrepreneurship

While there's no questioning the preeminence of the nation's metro startup hubs, the growth of dispersed innovation clusters in the last decade shows immense untapped potential in the heartland. From Austin to Madison to Kansas City to Cincinnati, burgeoning tech hubs have emerged to capitalize on factors like lower costs, an unmatched quality of life, and a diverse, skilled talent pool.

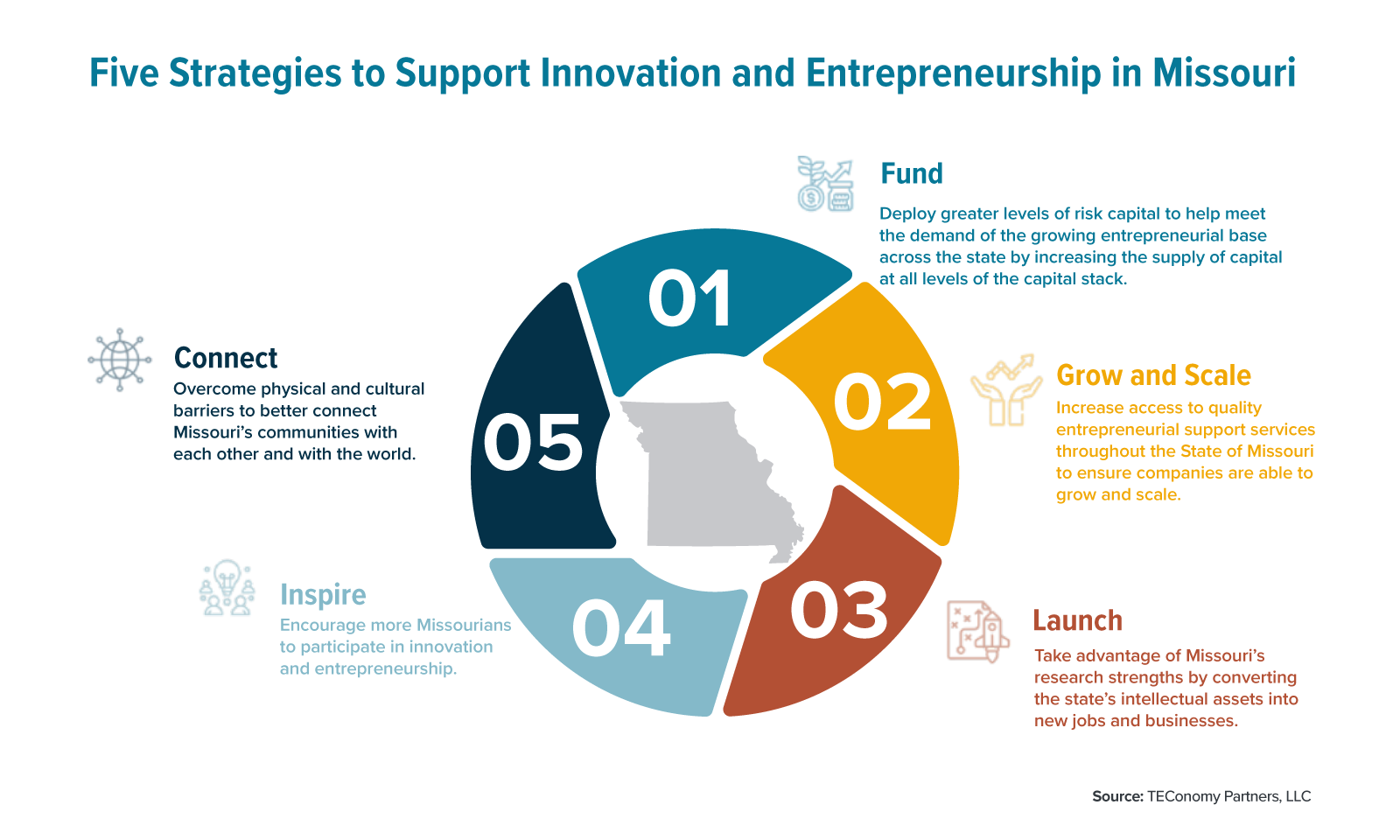

In 2022, the Missouri Technology Corporation (MTC) released Catalyzing Innovation: Strategies for Missouri to Drive Innovation and Entrepreneurship.8 This study is the culmination of Missouri’s ecosystem stakeholders and partners coming together to form a new, bold strategy for encouraging inclusive, entrepreneurial-led economic growth across the state. The strategic plan focuses on developing a systemic entrepreneurial ecosystem with the requisite support mechanisms in place to encourage growth in traded-sector industries across the State of Missouri.

At the onset of this strategic initiative, MTC gathered a steering committee of 16 thought leaders from across the state to help guide the effort. Using a multi-pronged, qualitative approach, this effort involved outreach to approximately 500 individuals throughout the state’s innovation and entrepreneurship ecosystem.

Within Missouri’s innovation and entrepreneurship ecosystem, five key challenges were identified as inhibiting entrepreneurial growth. Thus, the resulting plan includes five strategies and an associated set of 16 key actions needed to increase opportunities for more traded sector firms to grow and scale in Missouri.

#1 Strategic Recommendation - Deploy Greater Levels of Investment Capital.

The first recommended strategic approach in the statewide plan was to deploy greater levels of investment capital to help meet the demands of the growing entrepreneurial base. While the amount of risk capital dollars invested in Missouri had grown, the number of deals has declined. This suggests a shift toward larger later-stage investments and fewer early-stage deals, making it difficult for many entrepreneurs across Missouri to access risk capital. Based on the Carta data from 1H 2023, this finding was accurate.

#1 Action - Catalyze additional investment capital funds across the capital stack.

The first recommended action in the plan was to:

- Support the generation of additional indigenous pre-seed, angel, seed, and early-stage venture capital funds in Missouri managed by resident private fund managers.

- Pilot innovative financing options that fill gaps in the state’s ecosystem, such as revenue-based financing for business models that do not traditionally attract risk capital dollars, and direct investments for founders from underserved populations (demographic or geographic).

Today, we are announcing the culmination of efforts of several partners spanning nearly two years, to create an innovative solution to a long-standing problem that limits opportunity for tech founders across southern Missouri to start and grow job-creating companies. The solution is closely aligned with the recommended strategies and actions of one of the nation's leading tech-based economic development consulting firms, and Missouri’s leading organization responsible for catalyzing innovation.

A Hybrid Solution: Venture Philanthropy Meets Venture Capital

This pioneering co-investment model empowers the funds to maximize impact in the earliest, riskiest stages where startup funding is most scarce, especially in areas where traditional investment models often fall short. By concentrating on startups within southern Missouri, Innovate SOMO Funds will support innovation in a range of locally important industry sectors including information technology, tech manufacturing, financial services, healthcare, and agriculture, and drive economic growth, and job creation where it’s needed most.

Key facts about the Innovate SOMO Funds

- Total fund size: $2 million, from combined nonprofit and for-profit funds

- Geographic focus: 47 southernmost counties served by the Southern Missouri Innovation Network

- Investment focus areas: High-growth potential software focused or enhanced solutions in most industries

- Target investment stages: Pre-seed and seed

- Co-investment model: Equity and revenue-based investments from nonprofit and for-profit funds

- Limited partner investors: Leading foundations, family offices, institutional, and accredited investors

Innovate SOMO Funds anticipates most investments will range from $50,000 - $200,000 and will include other strategic co-investors. The goal is for the initial vintage of the Funds to be deployed in two to three years. Before beginning any formalized or public fundraising, the funds have received $700,000 in commitments of investments and support from local partners. Initial investment is led by the Hatch Foundation, located in Springfield, Missouri and an anonymous donor from Cape Girardeau, Missouri.

The Innovate SOMO Funds have also received support from leading financial service organizations in the region. The Bank of Missouri, founded in Perryville, Missouri with branches serving communities across southern Missouri, has committed $100,000 to help offset administrative and management costs of the funds for the first two years.

Upon the creation of Innovate SOMO Funds, Accelerate SGF, Inc., a subsidiary of Springfield Innovation, Inc., transferred ownership of previous investments made by its accelerator program, which was delivered by efactory. The accelerator program made $30,000 equity investments to help support 21 startup companies. These investments and remaining cash in the last fund were donated to Codefi’s new non-profit fund.

Expanding the Startup Funnel

Innovate SOMO Funds, working hand-in-hand with Codefi and efactory, creates an ecosystem that not only provides crucial seed capital but also the critical coaching and resources necessary to effectively launch and fuel the growth of promising startups. In August 2023, the organizations announced the launch of a comprehensive pipeline of programs that increase the capacity for attracting and supporting a larger number of tech-based startup concepts, founders, and companies from idea to growth. The cohesive system of programs and services has never been offered to entrepreneurs and innovators in the region.

From aspiring founders participating in a pipeline of consulting-style training to developers upskilling into sought-after tech roles, these grassroots efforts are increasing both the quantity and quality of startups being formed. Providing a clear pathway from team formation through seed funding not only catalyzes individual company growth - it fortifies the entire regional startup ecosystem.

Our bold model gets to the root of the pipeline problem by equipping more entrepreneurs from day one with the coaching, incentives and early funding access to maximize their chances of success. By expanding the funnel, Codefi and Innovate SOMO aims to reduce two major friction points - lack of founder know-how in building scalable tech startups, and limited capital during the critical transition from concept to initial product and traction.

Catalyzing Economic Renewal through Tech Impact

Beyond the direct jobs and wealth creation impact, the rise of thriving tech startup ecosystems can dramatically elevate a region's quality of life. Industry giants and household names like Meta, Apple, Microsoft, Amazon and Google were all startups once - founded with entrepreneurial grit and visionary ideas that resonate globally. Today's high-potential tech seedlings could birth tomorrow's transformative solutions tackling humanity's greatest challenges.

Just as importantly, flourishing startup scenes attract and retain diverse, world-class talent - the lifeblood of vibrant communities. Savvy college graduates, developers, innovators and creatives increasingly prize dynamic local tech ecosystems that offer professional opportunity without sacrificing affordability or livability. Regions able to stake their claim as havens for tech entrepreneurship and talent gain massive opportunities in other sectors of the economy.

Conclusion

A hybrid venture philanthropy and venture capital fund offers a powerful tool to close the funding gap for early-stage tech startups. By combining the best of philanthropy and venture capital, these funds can drive job creation, spur innovation, and transform communities. As we look to the future, this pioneering model presents a compelling opportunity to unlock the full potential of tech startups and drive lasting, positive change across our region.

Innovate SOMO Fund's bold model upends this systemic geographic discrimination by earmarking both philanthropic and venture investments for underestimated startup communities. In doing so, the fund levels the playing field of opportunity by bridging critical capital gaps, while providing needed coaching and resources through on-the-ground partners.

Relevant Links

1Codefi

2efactory

3Southern Missouri Innovation Network (Innovate SOMO)

4Nearly 80% of venture funds raised in just two states as US LPs retreat to the coasts

5U.S. Startups Create Jobs at Higher Rates, Older Large Firms Employ Most Workers

6Show-Me-Jobs

7State of pre-seed fundraising: Q2 2023

8Catalyzing Innovation: Strategies for Missouri to Drive Innovation and Entrepreneurship